The Financial market is a mixture of buyers and sellers where traders deal with his own recommendations as well as with the help of mentors in respect to have stock market tips, so we are one of them as known Ripples Advisory Private Limited we derive our suggestions direct from the Share and Stock Market!

Monday 9 October 2017

Sobha Surges 9% as CLSA Maintains buy after Strong Pre-Sales Data

Sobha share price rallied nearly 9 percent intraday Monday as global brokerage house CLSA has maintained its buy rating on the stock with a target price of Rs 525 after strong pre-sales data.

The Bangalore-based real estate company during the second quarter achieved new sales volume of 8.61 lakh square feet total valued at Rs 675.1 crore with an average realisation of Rs 7,840 per square feet.

The company has achieved this growth without launching any new projects during the quarter.

Get Free 2 Days Free stock future Hni Calls and more click here for more and call us:-9644405056>>http://ripplesadvisory.com/stock-future-hni-.php

This showed the growth of 5.6 percent and 8.3 percent in sales volume and total sales value compared with previous quarter, respectively while on year-on-year basis, sales volume was marginally higher and total sales value increased by 22.5 percent in Q2FY18.

Sobha said its share of sales value stood at Rs 592.7 crore (out of Rs 675.1 crore) with an average realisation of Rs 6,883 per square feet, up 5.3 percent QoQ and 14.4 percent YoY.

"The new sales value of Rs 592.7 crore achieved during the second quarter of 2017-18 is highest in past 10 quarters," it said.

The growth was supported adequately by an improved performance in the Kochi market followed with a consistent traction in other markets.

CLSA said steady execution & good portfolio helped the company to perform well. It expects pre-sales to do well for the next few quarters.

At 10:34 hours IST, the stock price Sobha was quoting at Rs 416.95, up Rs 25.70, or 6.57 percent.

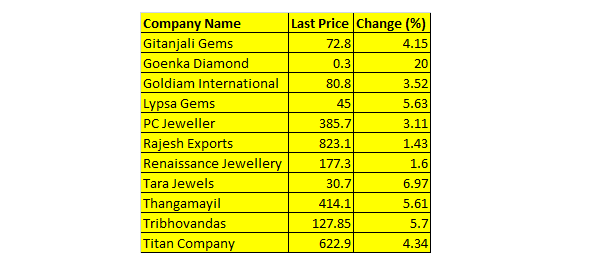

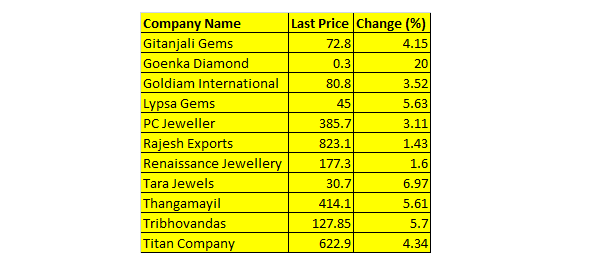

Gitanjali, Titan, TBZ rally 4-6% as jewellery purchases above Rs 50,000 won't need PAN

Jewellery stocks rallied 2-20 percent on Monday after the Government withdrew its GST notification on gems and jewellery.

Gitanjali Gems, PC Jeweller, Titan Company, Tara Jewels and TBZ gained 4-7 percent as Permanent Account Number (PAN) card and Aadhaar card will no longer be mandatory on the purchase of jewellery for over Rs 50,000.

This raised hopes for likely increase in demand for jewellery in Diwali festival (especially Dhanteras day).

Dhanteras is considered to be an auspicious day for buying gold, silver and other valuables and is largely celebrated in North and West India.

The government has taken this decision at its 22nd GST Council meeting on Friday.

GET FREE STOCK TIPS FROM HERE- HURRY UP LIMITED OFFERS >>http://ripplesadvisory.com

During last Dhanteras, gold and jewellery sales had risen by up to 25 percent on higher demand in view of good monsoon and favourable price levels, as per the industry body data.

CLSA said the government deferring PMLA for the sector came at the right time, given the ensuing festive season.

Titan remained its preferred pick. It has a buy call on the stock with a target price of Rs 700 per share.

In a notification issued on August 23, the government had brought jewellery dealers under the purview of the Prevention of Money Laundering Act 2002 (PMLA) and were told to report on buyers making purchases over Rs 50,000. Therefore, PAN and Aadhaar cards were made mandatory as part of 'Know your customer (KYC)' rule.

India is the world's largest gold consumer and imports a sizeable chunk of its total annual consumption of around 900-1,000 tonne.

No firecrackers for Delhi-NCR: SC

The Supreme Court on Monday ruled that there will be no sale of firecrackers during Diwali, as it restored a November 2016 order banning the sale and stocking of firecrackers in Delhi and National Capital Region.

The Supreme Court on Monday ruled that there will be no sale of firecrackers during Diwali, as it restored a November 2016 order banning the sale and stocking of firecrackers in Delhi and National Capital Region.

A bench headed by Justice A.K. Sikri, while restoring the order, said: "We should see at least in one Diwali the impact of a cracker-free festivity."

However, the court said that the September 12, 2017 order lifting the ban on the sale and stocking of firecrackers in Delhi NCR will be back into effect from November 1.

Get Free 2 Days Free stock future Hni Calls and more click here for more and call us:-9644405056>>http://ripplesadvisory.com/stock-future-hni-.php

The Supreme Court on Monday ruled that there will be no sale of firecrackers during Diwali, as it restored a November 2016 order banning the sale and stocking of firecrackers in Delhi and National Capital Region.

The Supreme Court on Monday ruled that there will be no sale of firecrackers during Diwali, as it restored a November 2016 order banning the sale and stocking of firecrackers in Delhi and National Capital Region.

Subscribe to:

Posts (Atom)